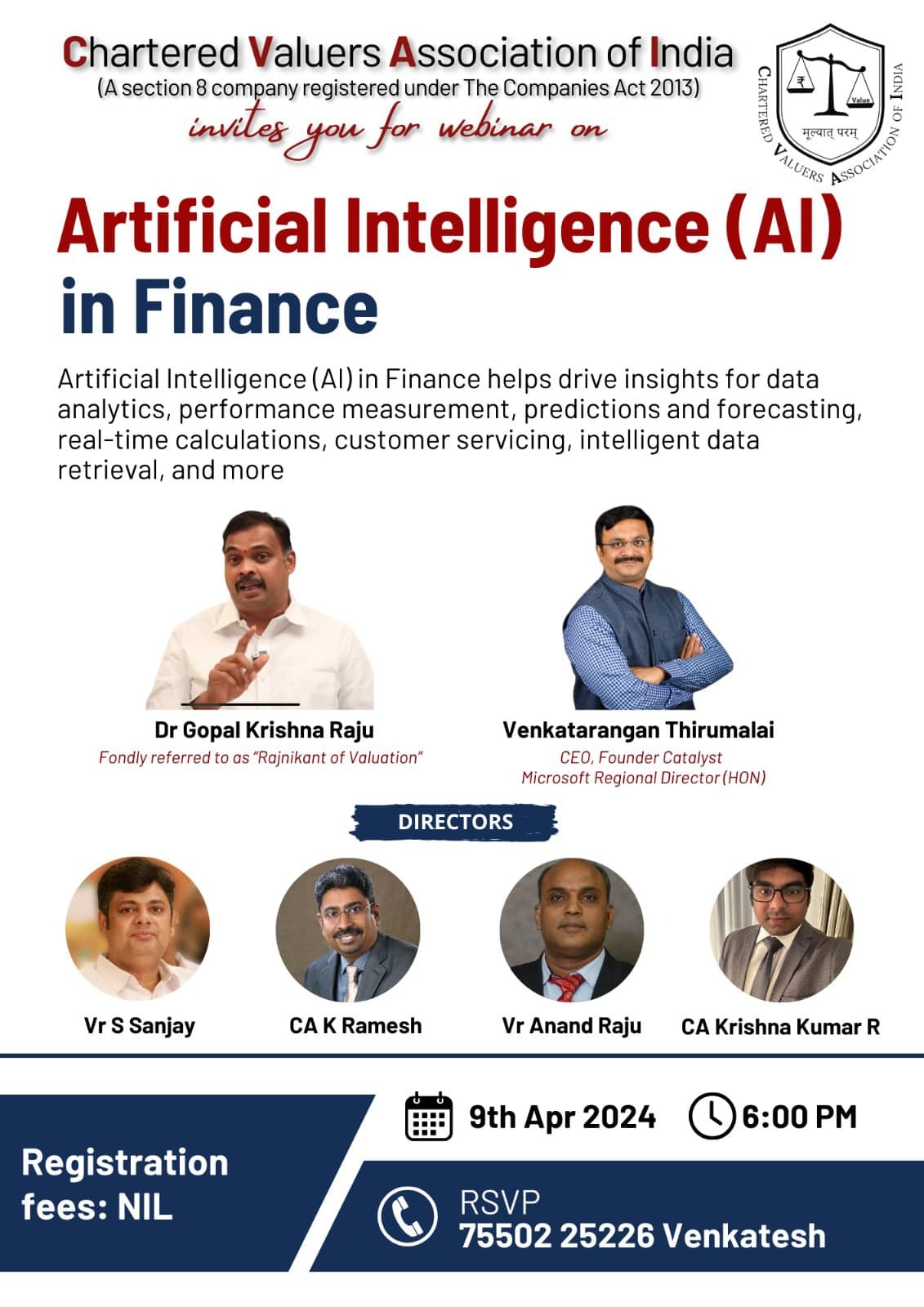

Artificial Intelligence (Al) in Finance helps drive insights for data analytics, performance measurement, predictions and forecasting, real-time calculations, customer servicing, intelligent data retrieval, and more

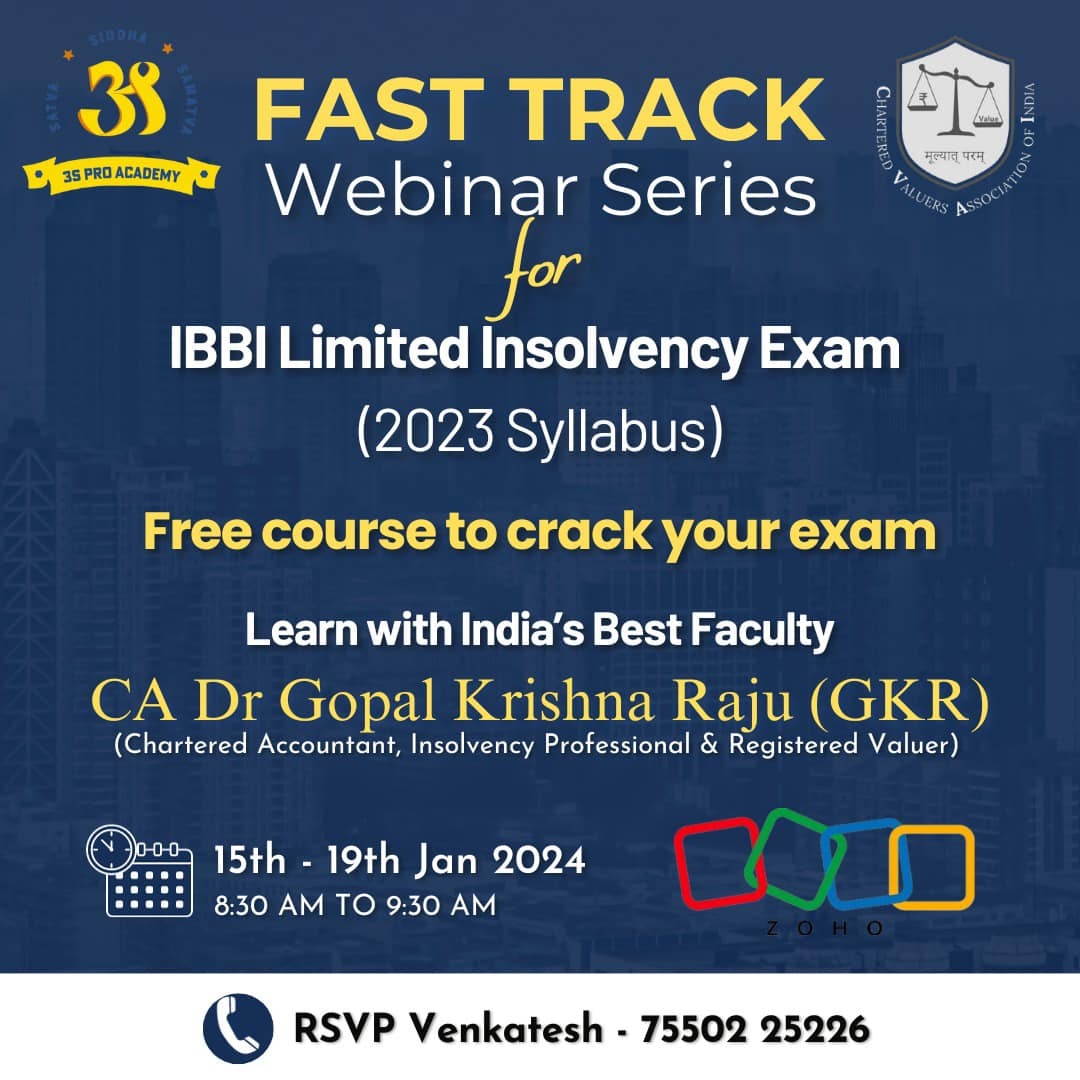

The proposed mediation framework is aimed at expediting resolution of insolvency cases and would best operate as a self-contained blueprint within IBC.

Remittances abroad is the money that is transferred or sent from India to Abroad by an Individual / Entity subject to RBI-FEMA regulations and Tax implications.

The CBDT has notified Income- Tax Return Forms (ITR Form)-1, 2, 3, 4, 5 and 6 for the Assessment Year 2024-25 will come into effect from April 1, 2024.

Latest section 43B(h) of the Income Tax Act, ensures timely payments to micro and small enterprises, the buyers need to make payments to the MSME sector within 45 days.

The CBDT has notified Income- Tax Return Forms (ITR Form)-1, 2, 3, 4, 5 and 6 for the Assessment Year 2024-25 will come into effect from April 1, 2024.

Income Tax and Double Taxation Avoidance Agreements Implication's for Non-Resident Indian Who want to Sell Immovable Property in India.

Raising funds for SMEs through Public and getting listed in SME Stock Exchanges